Data Vignette Series: Residential Instability in Oakland

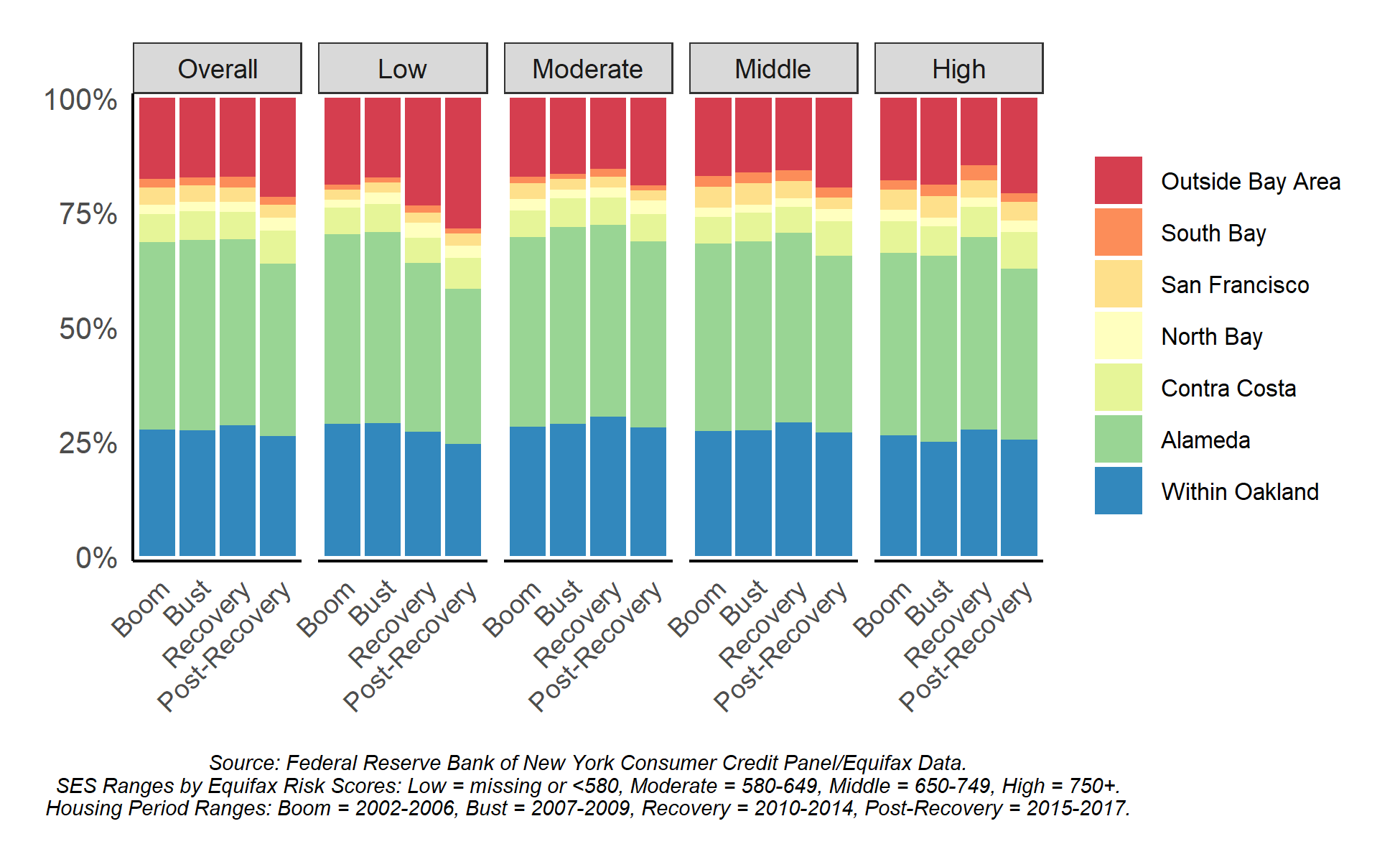

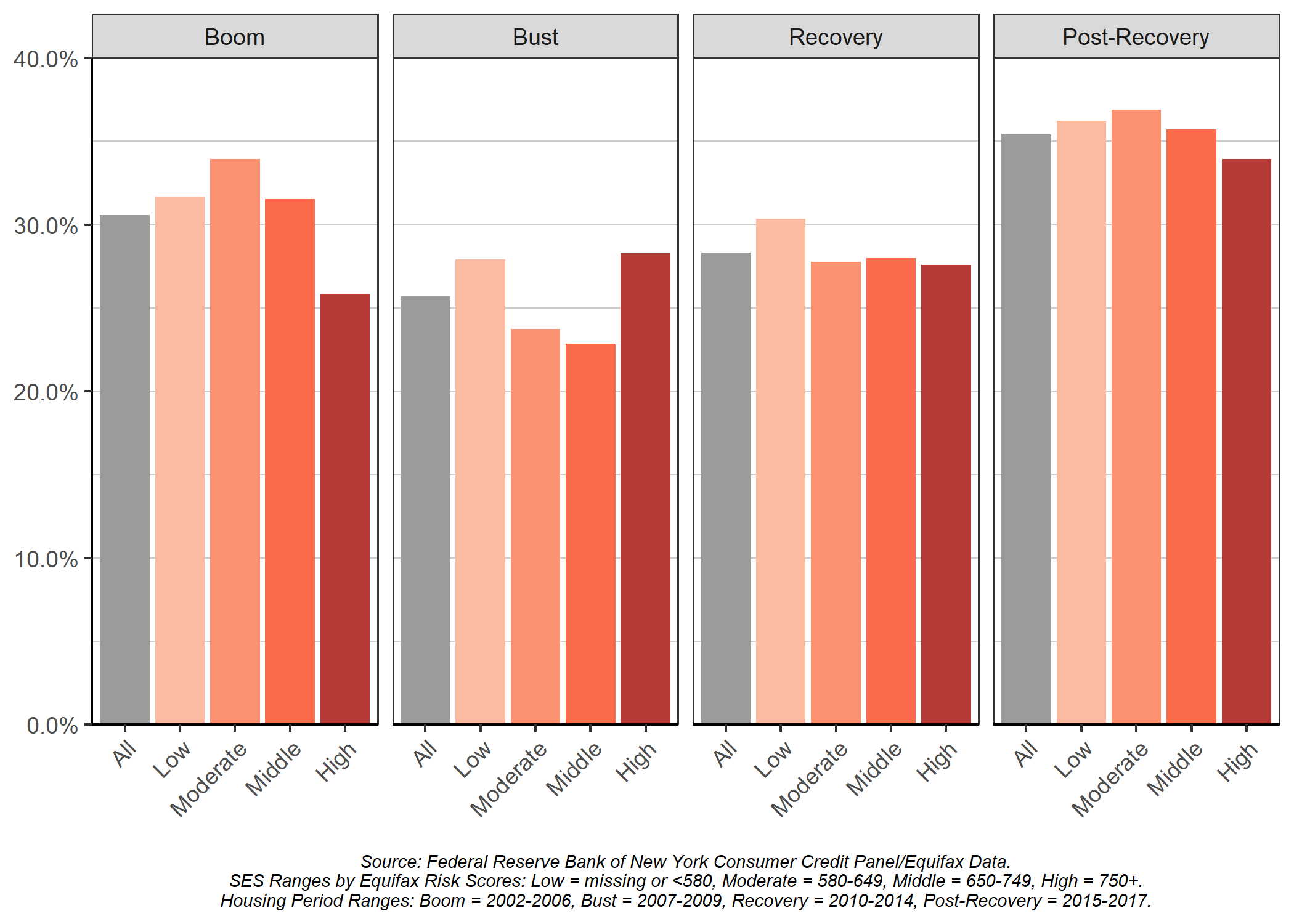

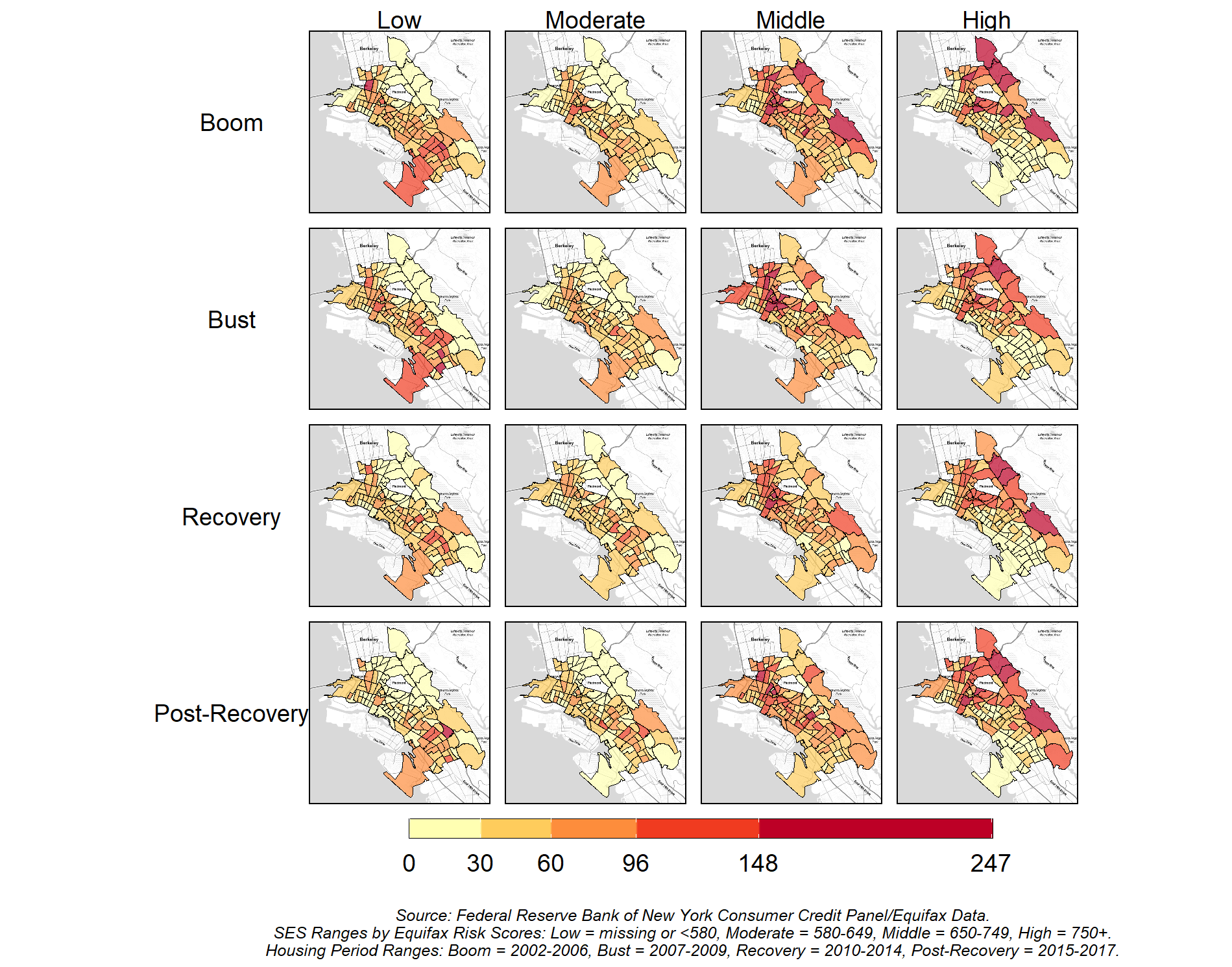

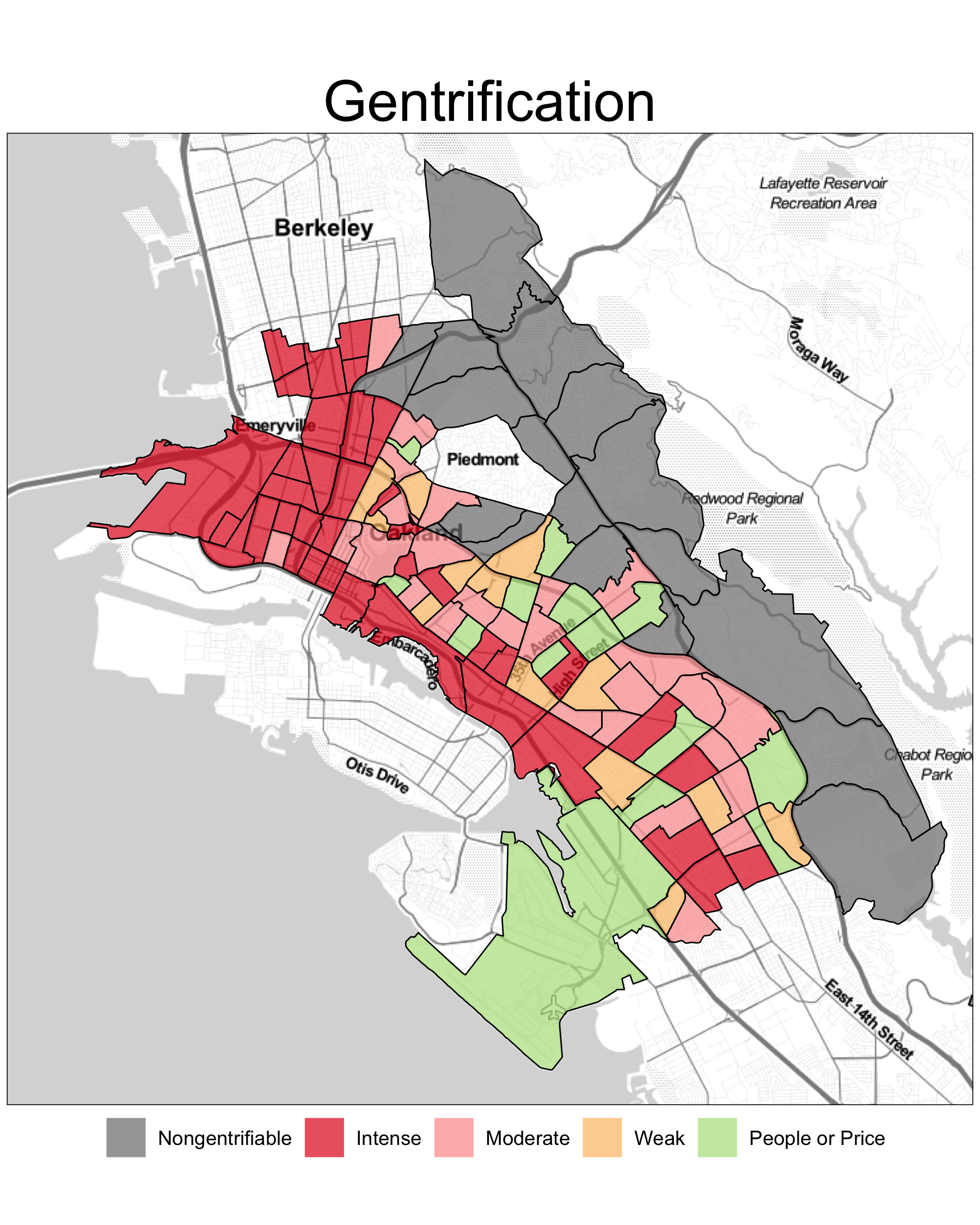

The Changing Cities Research Lab at Stanford University partnered with the City of Oakland’s Department of Housing and Community Development (HCD) and the Federal Reserve Bank of San Francisco’s Community Development Department to study residential instability in the City of Oakland over the last two decades, resulting from increasing gentrification and decreasing housing affordability. We leveraged data on mobility and financial health from 2002-2020 from the Federal Reserve Bank of New York’s Consumer Credit Panel/Equifax and administrative data on housing from the City of Oakland and Alameda County. In our analyses, we examined not only formal and informal forms of displacement, like evictions, foreclosures, and moving, but also invisible forms of residential instability before residents ever face displacement (e.g., financial instability, crowding) and where residents moved.

We recently published our findings in two reports: Neighborhood Change and Residential Instability in Oakland, and Residential and Neighborhood Instability in Oakland. These reports inform the City of Oakland HCD’s 2021-2023 Strategic Action Plan.

This series of data vignettes highlight our findings showing how and where different Oakland communities have been affected.

Read the Oakland Data Vignettes

Trends in Moving

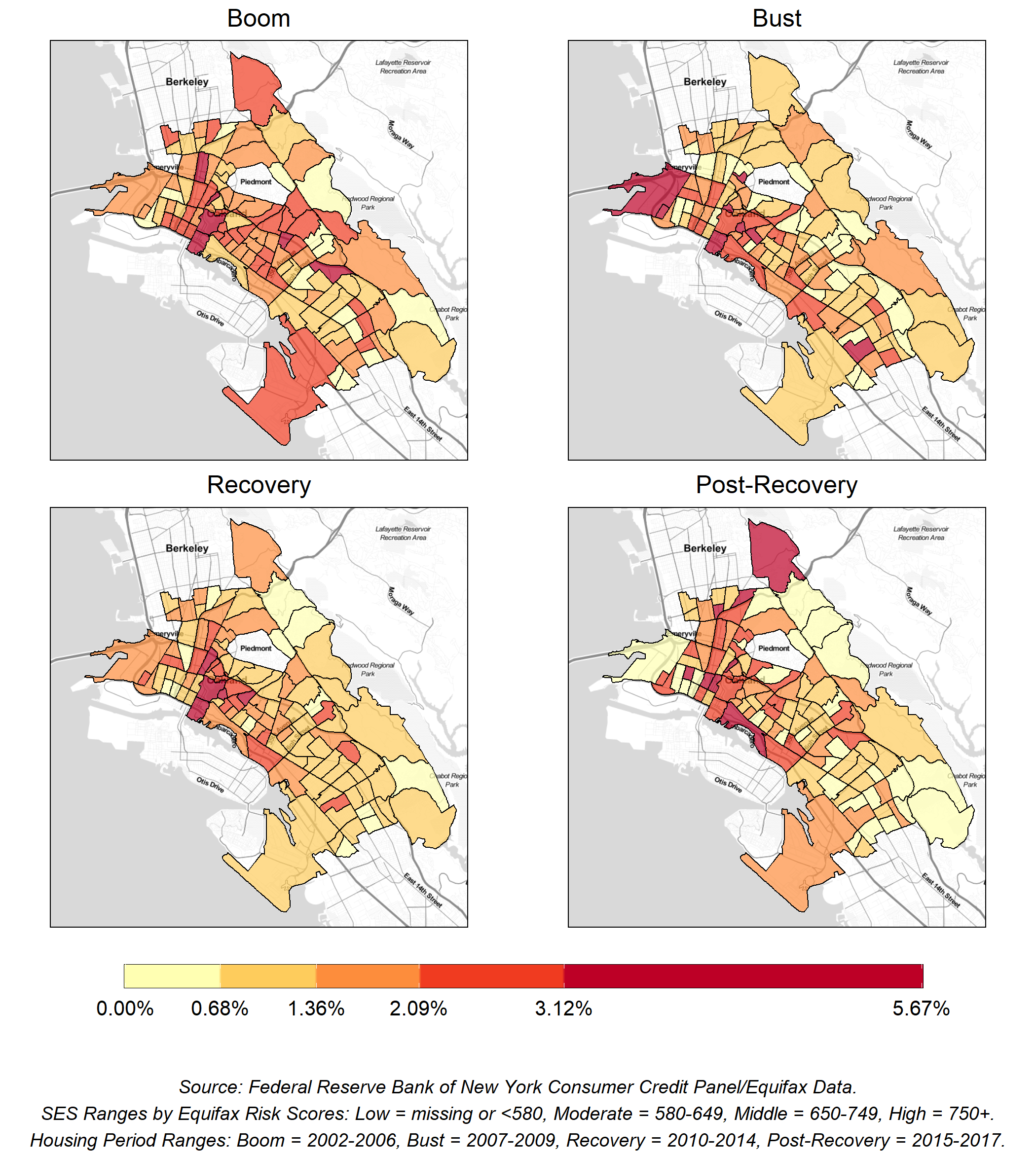

This is the first of a series of posts that highlight our findings showing how and where different Oakland communities have been affected. This post examines how much Oakland residents have moved over the last two decades, which varies across the socioeconomic status (SES) of residents and across Oakland neighborhoods.

Constrained Choices after the Great Recession

This post highlights our findings on the extent to which Oakland residents have moved into crowded living situations and experienced financial instability since the Recession. Oakland residents moved much less after the Great Recession than before, but lower-socioeconomic status (SES) residents, based on credit scores, made more constrained choices after the Recession. Specifically, they faced tradeoffs with moving, which includes crowding and rising financial debt.

Moderate-SES Residents are More Vulnerable to Residential Instability

In this post, we expand on the vulnerability of moderate-SES residents to residential instability as the housing crisis continues. Moderate-SES residents have moved into lower-opportunity neighborhoods and crowded households more than low- and higher-SES residents in recent years.

A Tale of Two Cities - Residential Instability and Disinvestment in Oakland

This post delves into neighborhood trends to show how different neighborhoods across Oakland are impacted by displacement, crowding, financial instability, and disinvestment. Moving and moves to crowded housing have been concentrated in Downtown and parts of North/West Oakland, while financial instability and disinvestment have been concentrated in Deep East Oakland and some parts of West Oakland, particularly in historically Black neighborhoods.

Comparing the Effects of the Pandemic and the Great Recession

Data from 2020 suggests that the effects of the pandemic thus far have been distinct from those of the Great Recession, which lasted from 2007 to 2009. While we can borrow some of the valuable lessons learned from the Great Recession, this post highlights findings from our report on the impact of the pandemic on residential instability. These findings suggest that policymakers and housing and community practitioners need to adapt to the unique nature of the current pandemic.